Discover Credit Card For Students;- Discover is a financial services company that offers credit cards, personal loans, student loans, and banking services. Discover credit cards are known for their cashback rewards program, low fees, and customer-friendly policies.

Here are some features and benefits of Discover credit cards:

- Cashback rewards: Discover offers cashback rewards on every purchase made with their credit cards. The amount of cashback varies depending on the card and the category of the purchase.

- No annual fee: Most Discover credit cards don’t have an annual fee, which means you don’t have to pay to use the card.

- 0% intro APR: Many Discover credit cards offer a 0% intro APR on purchases and balance transfers for a certain period of time.

- Customer-friendly policies: Discover is known for its customer-friendly policies, such as no late fee on your first late payment, no penalty APR, and free FICO credit score monitoring.

- Security features: Discover credit cards come with security features such as fraud monitoring, zero liability for unauthorized purchases, and the ability to freeze your card if it’s lost or stolen.

Overall, Discover credit cards are a good choice for those who want to earn cashback rewards and avoid fees while enjoying customer-friendly policies and security features.

Related: Best Credit Cards in Germany for Students

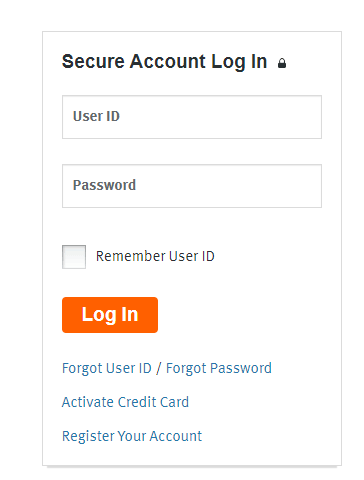

- Go to the Discover Card login page at https://www.discover.com/credit-cards/login/.

- Enter your user ID and password in the designated fields on the page.

- If you have forgotten your user ID or password, click on the “Forgot User ID/Password” link and follow the instructions to retrieve your login information.

- Once you have entered your login information, click on the “Log In” button to access your account.

- If you are logging in for the first time, you may be prompted to set up security questions and select a security image to help protect your account.

- Once you are logged in, you can view your account balance, transaction history, and make payments, as well as manage your account settings and rewards program.

Note: If you have any issues logging in or accessing your account, you can contact Discover customer service for assistance.

Discover Credit Card For Students

Is discover credit card a good for students?

- Cashback rewards: Discover offers cashback rewards on every purchase made with their credit cards. For example, the Discover it® Student Cash Back card offers 5% cashback in rotating categories each quarter (up to the quarterly maximum each time you activate), and 1% cashback on all other purchases.

- No annual fee: Most Discover credit cards don’t have an annual fee, which means you don’t have to pay to use the card.

- 0% intro APR: Many Discover credit cards offer a 0% intro APR on purchases and balance transfers for a certain period of time. This can be helpful for students who need to make large purchases or pay off other credit card balances.

- Customer-friendly policies: Discover is known for its customer-friendly policies, such as no late fee on your first late payment, no penalty APR, and free FICO credit score monitoring. These policies can be especially helpful for students who are new to credit cards and may need some leniency if they make a mistake.

- Security features: Discover credit cards come with security features such as fraud monitoring, zero liability for unauthorized purchases, and the ability to freeze your card if it’s lost or stolen.

Overall, Discover credit cards can be a good choice for students who want to earn cashback rewards and avoid fees while enjoying customer-friendly policies and security features. However, it’s important to remember that credit cards should be used responsibly, and students should only charge what they can afford to pay off in full each month to avoid accruing interest and getting into debt.

Does discover credit card have foreign transaction fees?

However, it’s worth noting that not all merchants may accept Discover cards outside of the United States. Before you travel internationally, it’s a good idea to check if your Discover credit card will be accepted in the country you’re visiting. You can also notify Discover of your travel plans to avoid any potential issues with fraud alerts or card blocks while you’re abroad.

Does discover credit card provide rental car insurance?

- Coverage: The rental car insurance offered by Discover provides coverage for physical damage and theft of the rental car. This coverage is secondary to any other insurance you may have, such as your personal auto insurance policy.

- Restrictions: There are some restrictions to the coverage, such as a maximum coverage limit and exclusions for certain types of vehicles and rental agreements. Be sure to read the terms and conditions of the rental car insurance carefully to understand the coverage and limitations.

- Activation: In order to activate the rental car insurance benefit, you must decline the rental car company’s insurance coverage and pay for the entire rental with your Discover card.

Overall, the rental car insurance offered by Discover credit cards can be a valuable benefit for cardholders who rent cars frequently. However, it’s important to read the terms and conditions of the coverage carefully to understand the limitations and requirements. If you have any questions or concerns about the rental car insurance offered by Discover, you can contact customer service for assistance.

Also See: How To Make a Lowes Credit Card Payment

Where is discover credit card not accepted?

- Outside the United States: While Discover cards do not charge foreign transaction fees, they may not be accepted by all merchants outside of the United States. It’s a good idea to check with your merchant or hotel in advance to see if they accept Discover.

- Some small businesses: Discover cards may not be accepted by some small businesses, especially those that only accept cash or certain types of credit cards.

- Some online merchants: While Discover is accepted by many online merchants, some may not accept Discover as a form of payment.

- Some government agencies: Some government agencies may not accept Discover cards as a form of payment for taxes or other fees.

Overall, Discover credit cards are widely accepted, but there may be some limitations depending on the merchant and location. If you have any questions about whether your Discover card will be accepted, you can contact Discover customer service for assistance.

Is discover credit card accepted everywhere?

Discover has a network of acceptance in over 190 countries and territories, which includes merchants that accept Discover cards for payment and ATMs that allow Discover cardholders to withdraw cash. However, the acceptance of Discover cards may be limited in some countries or regions, and some merchants may not accept Discover cards for payment.

To increase the likelihood of your Discover card being accepted, it’s a good idea to look for the Discover logo on the merchant’s payment terminal or website, and to check with the merchant in advance if you have any questions about card acceptance. Additionally, you can notify Discover of your travel plans to help prevent any potential issues with fraud alerts or card blocks while you’re abroad.

Overall, while Discover credit cards may not be accepted everywhere, they are widely accepted in the United States and many locations worldwide. If you have any questions about card acceptance or need assistance while traveling, you can contact Discover customer service for help.

Also See: 5 Ways to Pay Your QVC Credit Card – How to make a credit card payment QVC?

1 Trackback / Pingback