How to Become a Millionaire and Retire Young;- Do you doubt that you will be a millionaire someday? You may want to reconsider. If you are diligent in managing your savings, managing your spending, and sticking with it for a while, even someone with a modest income can become a millionaire and retire young.

Most people work their whole lives, hoping to retire comfortably at some point. But what if you could retire in your 20s or 30s? What if you could quit your job and still be able to live the life of your dreams? The idea of retiring early is now more possible than ever with the right strategies.

Also Read: 20 Proven ways how to make money fast

The idea of retiring early has become a more and more popular concept. One of the most popular ways to retire early is to invest in cryptocurrencies. Trading cryptocurrency is a risky investment but it can pay off if done correctly. If you’re considering quitting your job, financial experts recommend starting to invest in crypto now while they’re still affordable.

But, can you become a millionaire and retire young? It’s definitely a challenge. But this is possible with the 12 strategies listed below.

12 Strategies to Become a Millionaire and Retire Young

There are many paths to wealth, but one of the best is through investing. Warren Buffett is a great example and his approach has been used by people like John Bogle, Paul Graham and Ray Dalio. We’ve compiled 12 strategies for investing that have been proven to work in order to give you an idea of what it takes to become a millionaire and retire young.

1. Be a Value Investor:

Warren Buffett is the best example of this strategy and it’s been lauded by many investors like John Bogle and Paul Graham. The basic idea of a value investor is to find stocks that are undervalued because their fundamentals are strong, and then hold them for long periods of time, reinvesting dividends monthly to build wealth. over time. One potential problem with this strategy is that value stocks can be “overvalued” as well, which requires you to sell your stock for a profit before it falls again, or re-invest all of the profits you made in the stock.

This strategy works best for those who are patient and willing to wait for good long-term investment opportunities Become a Millionaire and Retire Young

2. Own Your Home, But Don’t Spend Much on It

It’s a common saying that owning a home is one of the best ways to build wealth, but with prices rising in major cities like New York, San Francisco and London it’s not always easy to buy a home. In order to get the most out of your home, you should take advantage of potential tax breaks like the mortgage interest deduction. The interest paid on a loan that you use to buy, build, or renovate a home is a deductible expense. The deduction reduces the taxable income of the borrower and can save you money on taxes.

3. Invest in Taxable Equities:

This is a strategy in which investors invest in stocks that are not considered “money-making” companies. These types of stocks usually pay higher dividends but they are subject to taxes, making them less attractive than other sectors. This is when an investor invests in stocks that are not considered “money-making” companies. These types of stocks do pay higher dividends, but they are subject to taxes, making them less attractive than other sectors. Become a Millionaire and Retire Young

4. Reduce Your Interest Expenses:

Long-term capital gains are taxed as income, so if you sell stocks that have risen in value, you could owe taxes on that profit down the road. One way to avoid hefty tax bills is to consistently pay off your mortgage (as long as the property was your primary residence). or other types of loans, which are often taxed as income. If you’re wondering what investments to make in 2022, the study recommends trading stocks in taxable equities and reducing your interest expenses.

Related Read: How To Get Amazon Direct Shipping Freebies in 2022 | Complete Guide

5. Take Advantage of a Roth IRA:

The United States introduced the Roth IRA in 1997, making savings tax-free after you reach a certain age. You can’t contribute to a Roth until you’re 18 but if you wait until you’re 50 or older, your contribution will be tax-free. .The U.S. introduced the Roth 401(k) in 2003, which allows you to contribute pre-tax money, meaning it will not be taxed at the time you contribute or when you withdraw your money later on in life. Become a Millionaire and Retire Young

6. Consider Your Cash Flow:

If you’ve been saving for a long time, look for ways to invest a portion of your cash flow in stocks rather than waiting until you’ve saved up enough money to make one big purchase. If you’re a business owner or aspiring entrepreneur, build your own personal cash flow by investing in stocks, following blogs like The Simple Dollar and The Personal Finance Blog, and reading books like Rich Dad Poor Dad. If you think it’s going to be a while before you get ahead financially because of the costs associated with raising children or caring for aging family members , then you may want to consider paying off your debts and putting money into savings.

What are some other strategies that can help you achieve Early Retirement? It is possible for some people to retire early if they have a pension or an earnings from sources such as real estate, dividends or interest. However, those who rely on these income sources should be realistic about

7. Don’t Forget Your Family:

When you’re saving for your future, think about what you could do with the money to make your family’s life easier and happier. If this includes paying down debt or saving towards a house deposit, that’s great! But if you can’t decide what to do with the money, consider making a charitable donation of some sort.

Related Read: 15 Ways to Make Money Online as a Teen

8. Avoid Buying on Margin:

If you’re looking to buy stocks, it’s best not to use any money that you don’t already have in your account, instead of borrowing the money from a brokerage firm. This is because borrowing money from a brokerage firm comes with an interest expense. When you buy stocks, you are effectively selling shares of the company in which you invested. For every share that is sold, the seller will receive a portion of the cash from your sale and pocket the rest. If you borrow money from a brokerage firm to invest, you will need to pay back the loan with interest. Become a Millionaire and Retire Young

This means that the amount of money that you will have at the end of your investment will likely be less than what you started with. Buying stocks on margin is a type of securities lending in which a broker borrows money from your brokerage firm to purchase stocks on your behalf. This can be risky because while the broker is repaying the loan, most brokers charge interest to the borrower. How does the margin call work?

The margin call occurs when a brokerage firm or its clearinghouse is required to sell your stocks because you owe them more than their value. This can happen if you are unable to make the required payments on time or if your account balance falls below the minimum deposit requirements for further. Become a Millionaire and Retire Young

9. Build Your Portfolio:

The more diversified your portfolio is, the less risk there is for any one stock option in your portfolio to lose or gain. One way to build a diversified portfolio is by adding bonds and other investments that produce income as well. as stocks. Lower Risk = Greater Return .“The more diversified your portfolio is, the less risk there is for any one stock option in your portfolio to lose or gain. ”This means that as the number of types of investments in a person’s portfolio increases, the potential for loss on individual investments decreases. Become a Millionaire and Retire Young

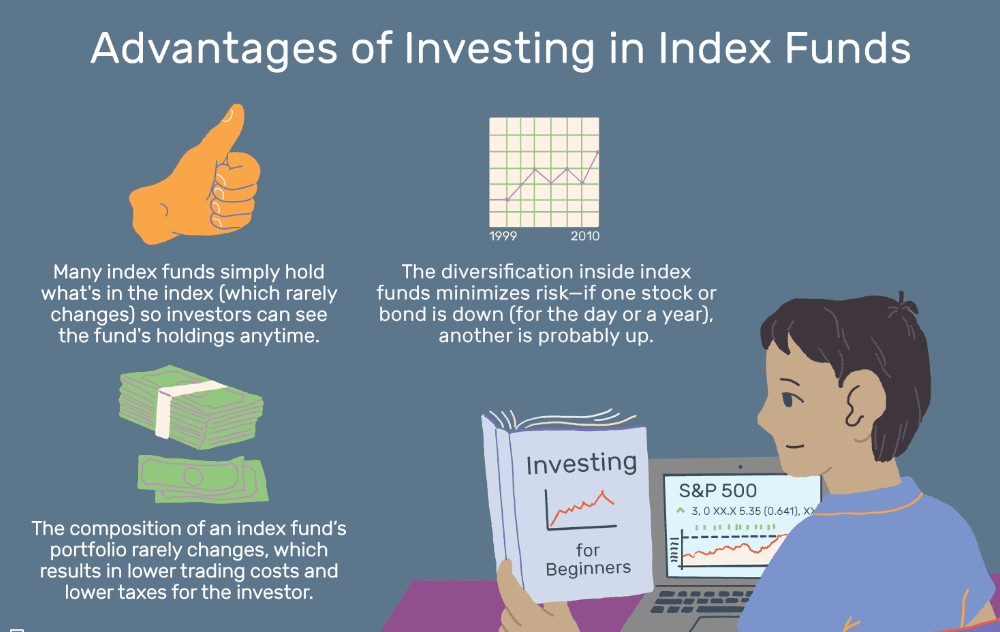

10. Use Index Funds:

Don’t put your money in individual investments that you don’t understand, but instead choose a low-cost fund like Vanguard’s index fund for the market, which invests in all the stocks of a given sector of the US stock market and in the US stock market as a whole. .If you’re investing $100,000 in the market, a Vanguard index fund costs $2,500 per year as opposed to the price of individual investments that can cost thousands. And with a portfolio of 500 stocks, you’ll be diversified and won’t suffer from any single stock’s decline.

You may Like: 20 Ways To Earn Money By Referring Friends in 2022

11. Don’t Invest More Than You Can Afford to Lose:

Before you invest, it’s important that you determine your tolerance for risk. If the chance of losing all your money is too high, then keep your investments low. On the other hand, if you’re willing to take on a small amount of risk, then you could invest a lot more. .Determining your tolerance for risk is important because you can’t make good decisions if you don’t know what the worst-case scenario is. One way to determine your tolerance for risk is to ask yourself these questions: “How long will my investment last?” and “What’s the worst that could happen if I lose all my money?”

12. Think Long Term:

Investing is about the long term and at the same time it’s important to keep in mind that your investments are going to fluctuate because of market demands and external factors. The best way to make money is by sticking with your investments over the long haul and holding on to them through thick and thin.

Conclusion on How to Become a Millionaire and Retire Young It is possible to retire early, or at least have a nice nest egg. It may seem impossible, but it’s not. The key is having the right perspective on what you need and what you actually want.

Be the first to comment