Inflation and Consumer Price Index (CPI);- Inflation is a measure of the rate at which the general level of prices for goods and services is rising and subsequently purchasing power is falling. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by consumers for a basket of goods and services. The Bureau of Labor Statistics (BLS) in the United States calculates and publishes the CPI on a monthly basis. It is used as a measure of inflation, as well as a tool for adjusting inflation-indexed financial instruments and for adjusting Social Security payments, among other uses.

Inflation is the rate at which the general level of prices for goods and services is rising and subsequently purchasing power is falling. It is usually measured by an index, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI), which compares the average price level in a given period to a reference period. The most common measure of inflation is the year-over-year change, which compares the average price level in a given year to the average price level in the previous year.

Inflation can occur for a variety of reasons, including an increase in the money supply, a decrease in the supply of goods and services, or an increase in demand for goods and services. When there is more money chasing the same amount of goods and services, prices will rise, resulting in inflation.

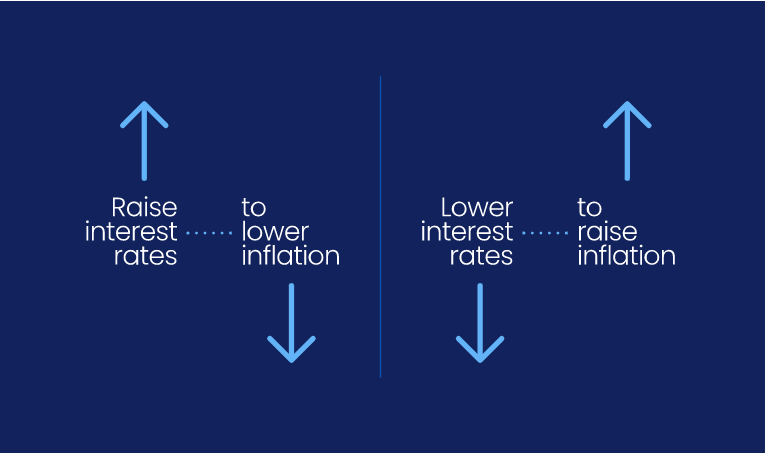

Central banks, such as the Federal Reserve in the United States, use monetary policy to try to control inflation. They may raise interest rates to decrease the money supply and slow inflation, or lower interest rates to increase the money supply and stimulate economic growth. Inflation and Consumer Price Index

It’s important to note that a small amount of inflation is normal and can even be beneficial for an economy, as it allows for adjustments in wages, prices and interest rates. On the other hand, high levels of inflation can be harmful as it can lead to decreased purchasing power, as well as uncertainty and potential instability in the economy.

Read More: Five Steps on Making Your First Trade in Forex

What is deflation?

Deflation is the opposite of inflation and occurs when the general level of prices for goods and services is falling, resulting in an increase in purchasing power. Deflation is usually measured by an index, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI), which compares the average price level in a given period to a reference period. The most common measure of deflation is the year-over-year change, which compares the average price level in a given year to the average price level in the previous year.

Deflation can occur for a variety of reasons, including a decrease in the money supply, an increase in the supply of goods and services, or a decrease in demand for goods and services. When there is less money chasing more goods and services, prices will fall, resulting in deflation.

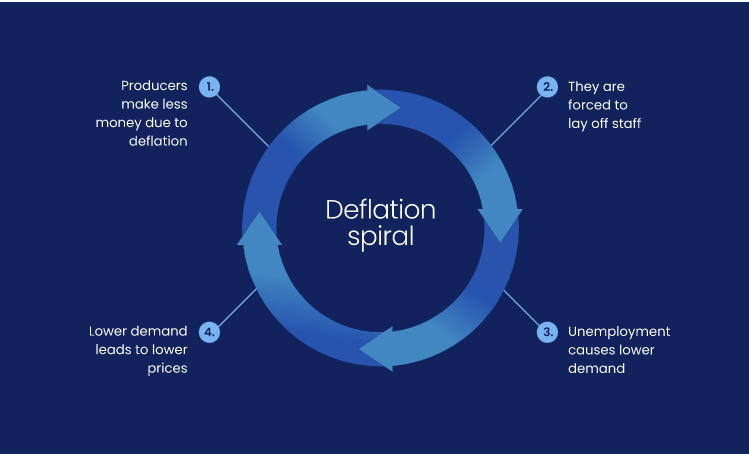

Deflation can be problematic for an economy as it can lead to lower output, employment, and investment. When prices are falling, consumers and businesses may delay spending as they expect to be able to buy the same goods or services for a lower price in the future, which can lead to a decrease in economic activity. Additionally, when prices fall, the value of debt increases, which can lead to financial stress for individuals, companies, and governments with outstanding debt.

Central Banks try to avoid deflation by setting targets for inflation rate and use monetary policies such as lowering interest rates, increasing money supply and other measures to stimulate economic growth and prevent deflation. Inflation and Consumer Price Index

Also See: Order Flow Trading Strategy: Forex Markets

Inflation and Consumer Price Index in Trading

In trading, inflation and the Consumer Price Index (CPI) can have a significant impact on the value of assets and the direction of the markets. Inflation can erode the value of cash and fixed-income investments, making stocks and real estate more attractive to investors. However, if inflation rises too quickly, it can cause market volatility and uncertainty.

On the other hand, Consumer Price Index (CPI) data is closely watched by traders as it is considered a key indicator of inflation and is often used to forecast changes in interest rates. Rising inflation is generally associated with interest rate hikes by central banks, which can have a negative impact on bond prices and a positive impact on the currency. A low or falling inflation rate is generally associated with interest rate cuts or no change, which can have a positive impact on bond prices and a negative impact on the currency.

In addition, many commodities are sensitive to inflation due to their relationship with production cost. A rise in inflation can lead to an increase in the production cost and therefore commodity prices.

Overall, Inflation and Consumer Price Index data releases can have a big impact on the markets. Traders may adjust their positions based on their expectations for future inflation, whether it be through buying or selling stocks, bonds, currencies, or commodities.

When is CPI released?

The Consumer Price Index (CPI) is typically released on a monthly basis by the Bureau of Labor Statistics (BLS) in the United States. The release schedule is usually announced in advance, but the exact release date may vary from month to month.

The CPI report is released at 8:30 AM Eastern Time on the second or third Friday of the month, depending on the calendar, covering the previous month data. The BLS also releases the Advance Report on Consumer Price Index (CPI) and the Final Report on Consumer Price Index (CPI) which covers all the details of the monthly report.

It’s important to note that the release of the CPI report can have a big impact on financial markets, as it is considered a key indicator of inflation and is often used to forecast changes in interest rates. Therefore, traders and investors often pay close attention to the release of the CPI report and may adjust their positions based on the data. Inflation and Consumer Price Index

How the CPI affects forex

The Consumer Price Index (CPI) is an important economic indicator that measures the change in the average price level of a basket of goods and services consumed by households, and can have a significant impact on the foreign exchange (forex) market.

Rising inflation is generally associated with interest rate hikes by central banks, which can have a positive impact on the domestic currency. This happens because higher interest rates increase the attractiveness of holding domestic assets, including bonds and currency, which can lead to an increase in demand for the domestic currency. As the demand for the domestic currency increases, the value of the currency will appreciate against other currencies.

On the other hand, a low or falling inflation rate is generally associated with interest rate cuts or no change, which can have a negative impact on the domestic currency. This happens because lower interest rates decrease the attractiveness of holding domestic assets, which can lead to a decrease in demand for the domestic currency. As the demand for the domestic currency decreases, the value of the currency will depreciate against other currencies.

In addition, if the inflation rate of a country exceeds the inflation rate of other countries, it may lead to a currency depreciation because investors will want to move out of a country experiencing higher inflation in search of higher returns in other countries with lower inflation.

Overall, the Consumer Price Index (CPI) data releases can have a big impact on the forex market, and traders may adjust their positions based on their expectations for future inflation and interest rate changes. Read More on How To Trade Fundamental (CPI)

CPI trading strategy

There are several trading techniques for forex because it can fluctuate based on the Consumer Price Index.

To trade the CPI, you must understand what the market expects from inflation and what will probably happen to the currency if these expectations are satisfied or not.

In some circumstances—such as when deflation is rampant—an climate favoring more inflation will be welcomed, yet in more inflationary circumstances, higher inflation may be viewed negatively for the economy.

On a monthly basis, analysts provide their predictions for inflation, basing their conclusions on factors such as supply and demand dynamics, currency exchange rates, prices of important commodities, as well as fiscal and structural policies.

You might wish to add technical components to your strategy after the CPI report and subsequent analysis, looking to see if the price is responding to important support and resistance levels. For better trading decisions, technical indicators may offer some insight into the move’s short-term strength.

But just like other news releases, timing is crucial. Therefore, as forex spreads may significantly expand before and after the report, it might not be a good idea to initiate a position right before an announcement. Inflation and Consumer Price Index

Also See: How to Make Money From Forex Trading – The Beginner’s Guide to Forex Trading

CPI example

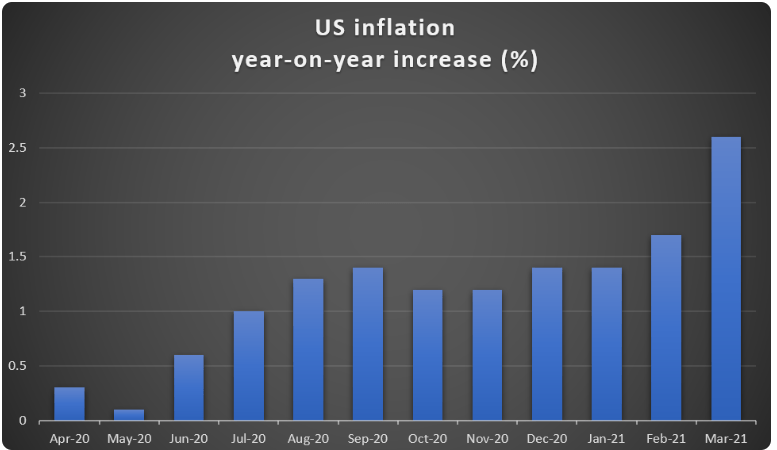

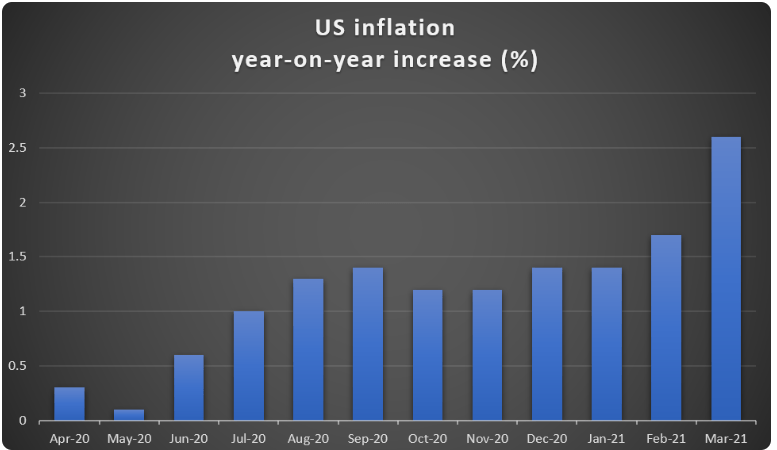

US inflation figures are displayed in the graph below as a percentage change from the same position a year earlier. Consumer prices were therefore 2.6% higher in March 2021 than they were at the same time the year before.

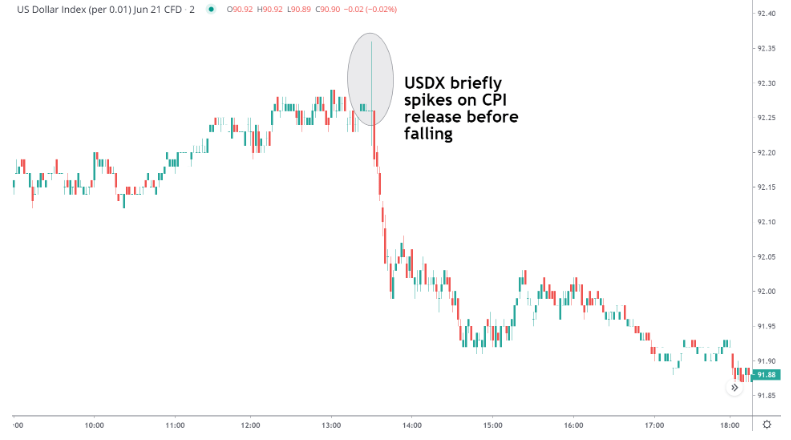

The US Dollar Index (USDX), which displays the performance of the USD against a basket of other currencies, can be an effective tool for US traders to investigate the implications of CPI data. Investors may keep an eye on USDX to change in accordance with the current release if it deviates from analyst estimates.

The USD briefly increased in response to the March 2021 CPI numbers (which were issued the following month), as the mark was marginally higher than analyst estimates. The USDX, however, declined as it became more apparent that interest rate hikes were most likely off the table for 2021, with the decline being supported by stagnant US treasury yields.

CPI takeaways for forex traders

- The CPI is a key statistic for estimating inflation rates.

- The action aids central banks in preserving price stability.

- When releases don’t match analyst forecasts, significant FX movements might happen.

- Be mindful of the timing of your entries to avoid being caught by expanding spreads.

Think of combining it with other economic indicators.

How CPI Affects the Dollar Against Other Currencies

The Consumer Price Index (CPI) can have a significant impact on the value of the dollar against other currencies. The Federal Reserve (the central bank of the United States) uses monetary policy to try to control inflation, and interest rate decisions are often based on the inflation rate as measured by the CPI.

When inflation is high, the Federal Reserve may raise interest rates to decrease the money supply and slow inflation. This can make the dollar more attractive to investors, as they can earn a higher return on their investments by holding dollars. As a result, the value of the dollar may appreciate against other currencies.

When inflation is low, the Federal Reserve may lower interest rates to increase the money supply and stimulate economic growth. This can make the dollar less attractive to investors, as they can earn a higher return on their investments by holding other currencies. As a result, the value of the dollar may depreciate against other currencies.

It’s important to note that the CPI is not the only factors that affect the dollar against other currencies, many other economic indicators and political events also have a significant impact. However, the inflation data (CPI) is considered as one of the most important indicators that can affect the value of the dollar.

Traders and investors often pay close attention to the release of the CPI report and may adjust their positions based on the data, changing their positions in the currency market in order to take advantage of any potential changes in the value of the dollar.

Most Frequently Asked Questions

-

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by consumers for a basket of goods and services. It is used as a measure of inflation and as a tool for adjusting inflation-indexed financial instruments.

2. How is the Consumer Price Index (CPI) calculated?

The CPI is calculated by taking the cost of a basket of goods and services at a given point in time, and comparing it to the cost of the same basket of goods and services at a previous point in time. The basket of goods and services is determined by surveying households on their spending habits and then weighting the items according to their importance in the overall consumption basket.

3. How often is the Consumer Price Index (CPI) released?

The Consumer Price Index (CPI) is typically released on a monthly basis by the Bureau of Labor Statistics (BLS) in the United States. The release schedule is usually announced in advance, but the exact release date may vary from month to month.

4. How can the Consumer Price Index (CPI) affect interest rates?

Rising inflation is generally associated with interest rate hikes by central banks, which aims to slow down the inflation. On the other hand, a low or falling inflation rate is generally associated with interest rate cuts or no change, which aims to stimulate economic growth.

5. How can the Consumer Price Index (CPI) affect the forex market?

A rising inflation rate in a country may lead to a currency appreciation, as higher interest rates increase the attractiveness of holding domestic assets, including bonds and currency. On the other hand, a low or falling inflation rate may lead to a currency depreciation, as lower interest rates decrease the attractiveness of holding domestic assets.

Be the first to comment